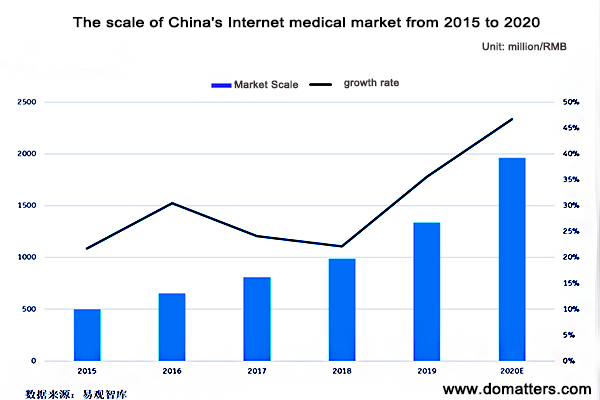

During the COVID-19 pandemic, Internet healthcare in China became the second main battlefield in the fight against the epidemic. Services such as online consultation, online follow-up visits, and delivery of medicines to home have reduced many unnecessary medical visits. It has played a huge role in helping medical staff improve their work efficiency and helping patients reduce the risks and costs of seeking medical care. Under the catalysis of the epidemic, how big is China’s Internet medical market? How will the trend of online medical care change? What are the investment opportunities for new medical services in China ?

As we all know , in China, medical care is a government-regulated industry . However, starting from a few years ago , the Chinese government has continuously introduced favorable policies for online medical treatment and Internet medical treatment.

On March 2, 2020, the National Medical Insurance Administration of China and the National Health Commission of China issued the “Guiding Opinions on Promoting the Development of “Internet +” Medical Insurance Services During the Period of Prevention and Control of the New Coronary Pneumonia Epidemic” (this article will be referred to as the “Opinions”). The document focuses on including eligible “Internet +” medical service fees into the scope of medical insurance payment; encouraging designated medical institutions to provide “no-face” drug purchase services, etc. This means that Internet medical services are connected to medical insurance payments.

date from yiguanzhiku

Use the customer quadrant theory to discover investment opportunities in China

Domatters china marketing agency categorizes the customers that the new medical service company faces, and can be roughly divided into the following four quadrants:

- Insurance. It includes medical insurance and commercial insurance.

- Pharmaceutical companies. It includes medical device companies.

- pharmacy. It includes retail pharmacies, DTP pharmacies and courtyard stores.

- Medical institutions . It can contain doctors.

As can be seen from the figure, the number of companies serving medical institutions is the largest in China. Because in China, although Chinese people are more inclined to go to large hospitals, especially the national tertiary hospitals, there are some problems in Chinese medical institutions such as seeing more patients and a large number of unmet information needs. Especially during the epidemic, it can be seen that the efficiency of China’s medical informatization is still relatively low.

In the quadrant of “pharmacy” , we can see that from the perspective of financial indicators, the pharmacy itself is not a very good business. This includes chain pharmacies. China’s pharmaceutical e-commerce has also experienced many twists and turns in its development. Of course, some well-developed companies have emerged, such as Ali Health.

For the quadrant of “pharmaceutical companies”, the pharmaceutical companies themselves are a high-margin, high-EBITDA business in China. Foreign-funded pharmaceutical companies have their own clear demands for efficiency improvement and are more willing to pay a premium for good services. Of course, this has also spawned many outstanding Chinese pharmaceutical companies that serve the R&D and marketing side of pharmaceutical companies.

After categorizing the customers of new medical services, the Domatters china marketing agency discovered a very interesting phenomenon-a lot of companies gradually migrated from one quadrant to another, doing a lot of cross-border things. Many excellent companies, after their initial quadrants are relatively stable, whether it is the migration from low EBITDA to high EBITDA, or the migration from high EBITDA to low EBITDA, this will increase the company’s barriers and enable the company to better adapt to the industry. competition.

For the digitalization of the medical industry, there are also many particularities. For example, on the C-side, it is not to obtain traffic, sell goods or publicity, but to obtain clinical data accurately and under the legal permission, understand the behavior of users, and ultimately guide clinical medications to serve doctors and patients. Only in this way can digitalization truly generate value.

What is “new medical service”?

According to the Citibank study in 2015, “new medical services” represent the flow of the entire medical industry chain. On the far left are pharmaceutical companies and medical device companies. On the far right is a provider of diagnosis and treatment services for ordinary patients. It includes public hospitals and private hospitals. In fact, it is from the production link to the circulation link.

*In the field of CRO.Can the endless new technologies such as R&D and production, computational chemistry, and deep learning of pharmaceutical companies really generate value in the fields of chemical synthesis, protein structure analysis, crystal form prediction, etc.? There are many opportunities in this field. You can invest in some technology-based CRO companies in China.

*In the CMO field.You can look for companies that can improve the efficiency of the industry, such as whether it can improve the efficiency of QA/QC, production, approval, and process optimization. Overall, Domatters digital agency china believes that there are still many opportunities for outsourcing and innovative services for pharmaceutical companies.

*Intermediate circulation, the entire pharmaceutical circulation in China is about 2 trillion market. CSO itself represents a market of more than 20 billion. Outsourcing in this market is still at a very early stage in China. We feel that there are many new investment opportunities in the circulation, including logistics and sales.

*The provider of medical services is the hospital. There are traditional medical informatization around hospitals, as well as some new informatization, including third-party laboratories, third-party testing, and third-party pathology services. There will be opportunities for new services.

*Next is the pharmacy, which provides drug selling services and Internet medical e-commerce. There are many opportunities for new trading platforms.

*At the top is the payer for medical services, including the most basic medical insurance and commercial health insurance in China. Regarding commercial health insurance, there are very mature PBMs abroad, but they are still relatively early in China.

The 6 trillion yuan in the entire medical industry seems to be very large, but from the perspective of our investment, the new medical service is about 2%-3% of the market space, corresponding to the 120-180 billion market.