Development Trend of Beverage Industry in China

In recent years, with the continuous and stable growth of national economy, the continuous improvement of residents’ consumption level and the upgrading of consumption structure, China’s beverage industry presents a good growth trend. If you want to start a business in China, please pay attention to the below content.

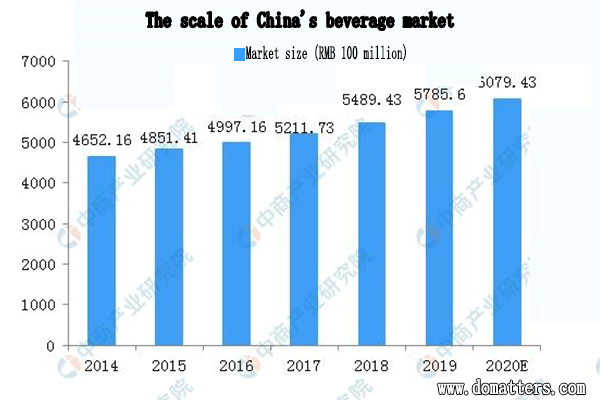

It is researched by Domatters that China’s beverage sales volume, including packaged drinking water, carbonated drinks, concentrated drinks, fruit juice, coffee drinks, tea drinks, energy drinks, sports drinks and Asian specialty drinks, increased from 465.216 billion Yuan in 2014 to 578.560 billion Yuan in 2019, with a compound growth rate of 4.46%.It is estimated that the beverage sales amount will exceed 600 billion yuan in 2020.

Photo data source: China Business Industry Research Institute

With more than 30 years of rapid development, China’s beverage industry has shown the following development trends:

(1) the variety of products and energy drinks are growing fast

With the continuous improvement of Chinese residents’ consumption level and the change of consumption habits, consumers’ demand for drinks presents a trend of diversification, which makes the categories and tastes of beverage products in China increasingly rich, and the development situation of each subdivision field is quite different. The Digital China Marketing Company researched that China’s beverage market was mainly composed of carbonated drinks and packaged drinking water In the 1980s and 1990s; at the beginning of the 21st century, tea drinks, fruit drinks and vegetable juices rose; in recent years, energy drinks and other special-purpose drinks, coffee drinks, and flavor drinks showed a rapid development trend.

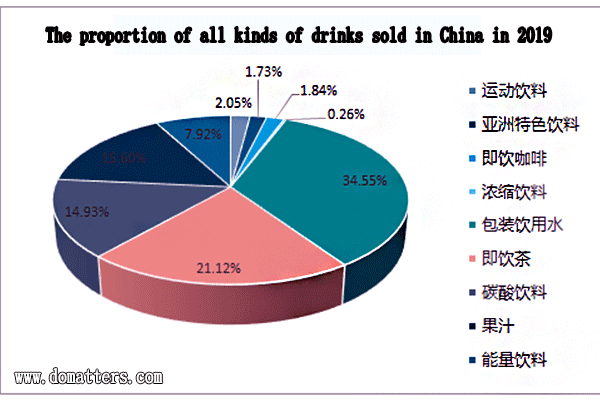

China’s beverage market has always been dominated by packaged drinking water, however instant tea drinks and carbonated drinks, accounting for 34.55%, 21.12% and 14.93% of China’s beverage sales in 2019. After years of development, juice drinks and energy drinks have also become an important part of the beverage industry. In 2019, the proportion of the two in China’s beverage sales is 15.60% and 7.92% respectively.

With the improvement of China’s residents’ consumption level, consumers’ demand for health and functional attributes of beverages is increasing. Among the various sub categories of beverages, energy drinks, ready to drink coffee, packaged drinking water and Asian specialty drinks show rapid growth beyond the industry. Among them, the compound growth rate of sales of energy drinks from 2014 to 2019 is as high as 15.02%, which is the fastest growing drink.

Proportion of various beverage sales in China in 2019

(2) Rapid growth of E-commerce and automatic sales channels

In recent years, the spread of vending machine outlets and the rapid development of Internet sales platform, China’s beverage industry clearly presents the characteristics of diversified development channels, and the proportion of drinks sold by vending machines and the E-commerce has increased greatly.

(3) The rapid rise of domestic brands drives the growth of domestic market and leads the trend of industry innovation

Multinational brands have a long history, high market awareness and relatively large market share. However, in recent years, domestic brands have risen rapidly, gradually increasing market share through differentiated products and marketing strategies, driving the growth of domestic market and leading the innovation trend of the industry. For example, Nongfu mountain spring, a domestic brand, has achieved outstanding performance in many fields such as packaged drinking water and tea drinks.

(4) Provinces with developed economy and large population have larger production and marketing scale, and other regions have great potential

Based on the differences of economic development level, total population and consumption concept, the production and consumption level of beverage in different regions in China are quite different. On the whole, the level of production and consumption of beverage in the areas with developed economy and large population is higher than that in other areas. Taking Guangdong Province as an example, Domatters found Guangdong Province’s beverage production accounted for 18.88% of China’s total beverage production in 2018. It can be reasonably inferred that the beverage consumption level in Guangdong Province is higher than the national average level. With the continuous improvement of residents’ overall income level, the extension of consumption channels and the innovation of ideas, the overall demand for drinks in other regions will gradually release, possessing greater development potential.

If you are interested in beverage industry in China, please feel free to contact us.