2017 ⇆ 2019, it suddenly without warning to refresh.It reminds us of our sorrow for time.Suddenly, Domatters Digital Marketing China realized that a lot of things had really passed.In addition to life and relationships, the same is true of business.The following Domatters will take a look at the issues that need attention in Chinese business.

- National situation Demographic issues: demographic dividend vs demographic anxiety

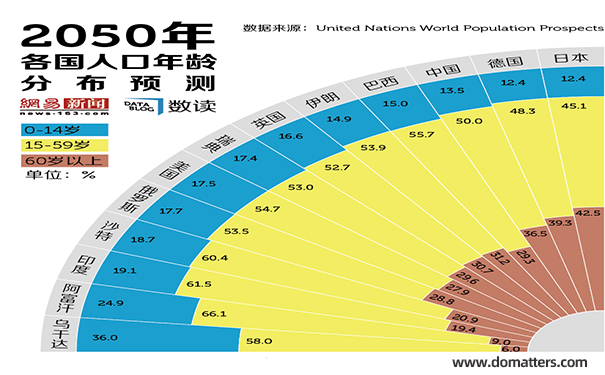

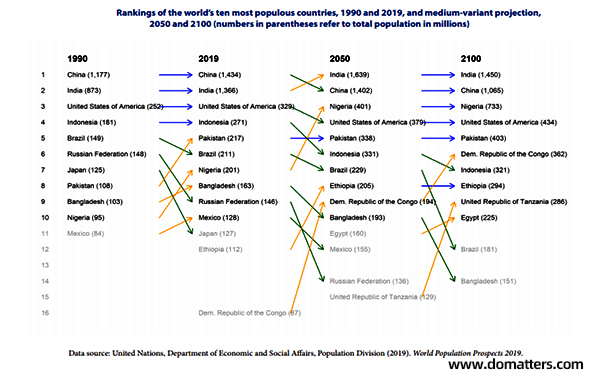

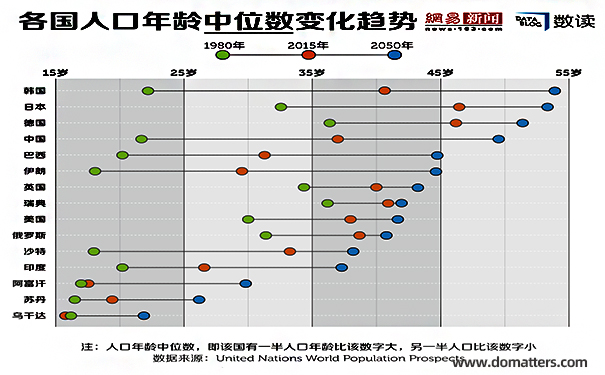

Before 2017, Chinese companies were talking about the word demographic dividend. But most people are talking about demographic dividends in the traditional sense. After two years of fermentation, the demographic dividend has become demographic anxiety. The current median age in China is 40 years old. In 1980, this number was only 22 years old. However, Germany now has a median age of 48, and aging in Western Europe and East Asia is particularly prominent.

Domatters believes that the problem should be viewed in two aspects. On the one hand, it is really in urgent need of improvement. On the other hand, because of Chinese huge body weight, although the number of newborns has fallen to about 1100w this year, it is still about equal to the population of two Denmark (Denmark 5.8 million). The total number of young people in China still exceeds the national population. The entire post-90s generation is 190 million (the other version is 188 million). The entire post-00s generation is about 140 million. The two together add up to 330 million, while the total population of the United States is only 320 million.

From the graph above we can see that many countries are aging.Therefore, from the perspective of this absolute number, China still has a lot of room for maneuver. In addition, the number of people in any dimension captured by Chinese enterprises is tens of millions or even hundreds of millions.

- Fund Investment: The Last Madness VS Return to Common Sense

2017 was the last time that more than 50% of the funds raised money. By this time in 2019, early investment was about to disappear. For more than half of the funds, the first fund raised is also the last one. A round of industrial revolution brought by the mobile Internet, and the dividends born there basically disappeared in 2017, but there were still many people with illusions.In one word, this is the final madness.

Return to common sense is the main theme of 2019. Today in 2019, mother funds have begun to make direct investments because they find that it is better to do it on their own than find a professional middleman. The fund is unwilling to look at the early stage, because it is basically cold. At the same time, they are all failing,such as the tuyere theory and circuit theory based on the previous eruption period, as well as the play of the US dollar fund in the past.

- Real estate:opportunism vs long-termism

In 2017, Chinese real estate industry was suppressed by a series of policies after experiencing a surge in 2015 and 2016. In the market’s expectations, a large number of people are still eager to move. In 2017, the stock market also sent “news”, because the common sense that many people understood is that the house will not rise, and the stock market will rise. In the past few rounds of water release, a group of people have indeed made a fortune, and they believe that this is the right way. In fact,any money made by luck will have to be made back by strength.

In essence, the appearance of long-term thinking is not because people suddenly become noble, but because the arbitrage space of short-term thinking is rapidly disappearing, forcing you to think long-term. Second, long-term thinking is not the opposite of short-term inaction, but a business model based on compound interest thinking. Many people frown when they talk about long-termism, thinking that I have to live now, how can I not make money, but the real long-termism is not to make you do not make money now, but to make the last copper plate of the moment. Leave sufficient energy for the broader sky in the future.

Those who seek big things do not seek small gains.To do business in China in the future, you need to pay more attention to [organization building], [product development], [brand depth], [supply chain building] and everything related to the business itself.

- Media issues: focus on frontline vs. sinking market

In 2017, Chinese mainstream media still only cared about the first-tier market.But the tier-one market does not represent China, and the idea that sinking markets still deserve respect has grown from a belief that few believed at first to a consensus.By late 2018, the concept of sinking markets was quickly exploding.

Standing on the tail of 2019, Domatters felt that it would not make much sense to discuss the sinking market. Because in fact a number of invisible champions have basically occupied the core advantage. Another group of giants has taken advantage of capital and resources, especially the technological advantages of Internet companies, to grab a large number of users faster. It can be said that the fundamentals of the sinking market have completely changed. After the sinking dividends are consumed, Chinese businesses are entering a more brutal fight.

- User issues: explosive growth vs deep inventory

One of the hottest words of 2017 is explosive growth, as if the absence of explosive growth is simply not worth doing.In the end of 2019, explosive growth is unlikely to occur in the big categories in the short term, and there may be more in the small categories and new categories.Companies that treat infertility have been listed overseas this year,and this is the emerging category.But on a larger scale, Domatters has not seen such an opportunity at present.

Chinese new normal is a relatively low rate of growth, but because of the world’s largest stock, it is urgent to shift to stock.This is the core reason for digging deep into the stock this year.And the essence of stock deep ploughing, in fact, is to forget those chicken thief method, that thing with addiction is easy to cannot extricate oneself.Let’s go back to customer value, because now the customer is not a fool, you’ve seen the world.

Sincerity becomes more valuable.And sincerity is embodied in [product], [service] and [price].

From 2019 to 2020, it is the most critical node to attract your existing users. After this point, your consumer may be completely snatched by another competing product of the same category. This is not to be alarmist, but to learn from the hotel and airline industry to be a customer and to learn the details of service from the Japanese service industry.

- Funding issues: valuation vs cash flow

At present has not listed a large number of star enterprises, if listed will break.Because what they got around 2017 was unreasonable primary market valuation, which exceeded the reasonable takeover price of the secondary market.So some investors can be said to be hit puffy face chubby, known as XX star enterprise investors.In fact, they are in the last paragraph, listed also can not make money.

Cash flow is the most important thing right now. In theory, as long as the cash flow is always positive, you will be able to survive the next huge wave. For example, there was a period of time when Li Hejun of Hanergy became the richest man in China, but Hanergy recently owed a salary of one billion yuan, which is that during the transition period, the prediction of cash flow was wrong, and many accounts could not be collected. It is said to be as high as 60 billion, and at the same time recruiting a large number of people at the same time led to rapid blood loss. Many times, good companies are on the front line before the crash. Everyone must be optimistic about their cash flow. Optimizing cash flow does not mean not spending money, which is something many people don’t understand. Forget what you value. The unicorn is almost out of horns, and there are only beasts left.

- Organizational issues: expansion vs. Layoffs

In 2017, many companies were aggressively expanding. But in 2019, it has entered a layoff contraction, and many large factories are now unable to enter. At present, the core problem is that there are not many mental workers with irreplaceable foundations, so enterprises cannot recruit people in core positions and backbone positions. But millions of college students who graduate each year don’t actually have the ability for core positions, so the concept of not studying after graduation must change.

The destiny of the brainpower practitioner is that if you want to get a premium, you must be better than 90% of the brainworker at the level, not hovering on the average. On the other hand, Chinese most scarce is technical staff, and the era when blue collars can live a decent life is coming.

Business in China has changed from 2017 to 2019.But Domatters Digital Marketing China saw more people come to their senses.Domatters has also seen more respectable businesses come to the fore.The future prospects for doing business in China are still good.

If you need to launch an APP in China or a small program or a new website, or you just need domatters to help you with SEO in China or other digital marketing work, please feel free to contact us.